In

Sapiens: A

Brief History of Humankind (2011), Yuval Harari narrates

the story of the company's founding: "In 1744, two Presbyterian

clergymen in Scotland, Alexander Webster and Robert Wallace,

decided to set up a life-insurance fund that would provide

pensions for the widows and orphans of dead clergymen. They

proposed that each of their church's ministers would pay a small

portion of his income into the fund, which would invest the

money. If a minister died, his widow would receive dividends on

the fund's profits. This would allow her to live comfortably for

the rest of her life. But to determine how much the ministers

had to pay in so that the fund would have enough money to live

up to its obligations Webster and Wallace had to be able to

predict how many ministers would die each year, how many widows

and orphans they would leave behind, and by how many years the

widows would outlive their husbands" (285).

Being Scots of that country's remarkable Enlightenment era

(memorably explored in Arthur Herman's

How the Scots

Invented the Modern World), Webster and Wallace did not

seek answers to these questions in divine revelation. Instead

they used "several recent breakthroughs in the fields of

statistics and probability," including Jacob Bernoulli's Law of

Large Numbers (which holds that, when very large numbers are

involved, it is possible to precisely predict average outcomes),

and also actuarial tables compiled fifty years earlier by Edmond

Halley from the records of the German city of Breslau (286).

Working with these tools, they calculated what the premiums

would need to be, and predicted that in two decades, "by the

year 1765 the Fund for a Provision for the Widows and Children

of the Ministers of the Church of Scotland would have capital

totalling £58,348. Their calculations proved amazingly accurate.

When that year arrived, the fund's capital stood at £58,347"

(287). In

At Home (2011), Bill Bryson too notes that

Halley's "were the first actuarial tables, and, apart from

anything else, they made the life insurance industry possible"

(480).

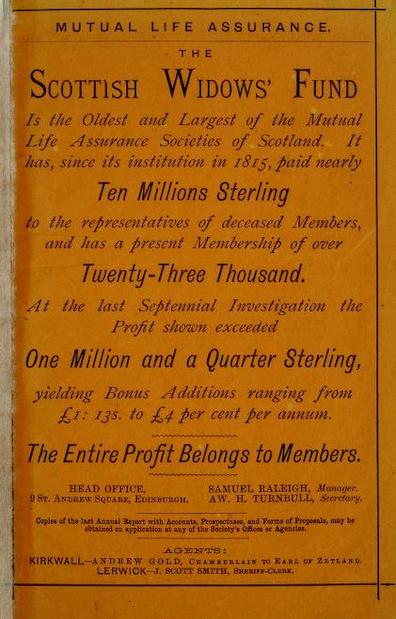

In 1815, responding to the great number of families impoverished

by men's deaths in the Napoleonic wars, the Scotsmen's purely

local enterprise became a publicly traded corporation on the

Edinburgh stock exchange, providing financial services to anyone

in the UK. The company grew throughout the 19th century, and at

the time represented in the novel it had an office on

Westmoreland Street in Dublin. Today Scottish Widows, as it is

called, is a subsidiary of the Lloyds Banking Group with

holdings in the range of $100 billion. It is still headquartered

in Edinburgh, but it operates internationally and cover more

than male heads of households.

In

Ulysses, though, this financial services company

fulfills exactly the role for which it was created in 1744:

saving widows and orphans from the disastrous loss of the family

wage-earner. Mrs. Dignam dramatically acts the part in

Circe:

"

She holds a Scottish widow’s insurance policy and a large

marquee umbrella under which her brood run with her,

Patsy hopping on one shod foot, his collar loose, a hank of

porksteaks dangling, Freddy whimpering, Susy with a crying

cod’s mouth, Alice struggling with the baby." In

Hades

Ned Lambert reports that

Martin Cunningham has

been taking up a collection for the family, "

Just to keep

them going till the insurance is cleared up." The task of

delivering these two pieces of news has brought Bloom to

Newbridge Avenue, Sandymount in

the early evening hours before the beginning of

Nausicaa.

What exactly needs to be "cleared up" regarding the insurance

policy? This information is supplied in

Cyclops.

In the bar Bloom tells Joe Hynes that he is looking for Martin

Cunningham to discuss "

this insurance of poor Dignam's.

Martin asked me to go to the house. You see, he, Dignam, I mean,

didn't serve any notice of the assignment on the company at the

time and nominally under the act the mortgagee can't recover on

the policy." "Holy Wars," says Joe, "that's a good one if old

Shylock is landed. So the wife comes out top dog, what?" In

response to this puzzling exchange, Gifford observes that

"Technically under British law, when an individual borrowed

money, mortgaging his insurance policy as security, the mortgage

was not valid unless the insurance company that issued the

policy had been notified. This legal loophole was the source of

considerable litigation, but attempts to void a mortgage based

on the fact that the insuring company had not been notified of

the mortgaging of its policy were rarely successful in the

courts."

This would explain Hynes' reaction: Mrs. Dignam, he supposes,

may be able to avoid repaying the Jewish man who loaned her

husband money because Dignam failed to tell the insurance

company that he had used its policy as collateral. It does not

address the question of what may happen to Mrs. Dignam if the

courts find

for the moneylender, as Gifford notes

usually happened. In that case, presumably the "Shylock" would

sue to recover his funds from the Dublin widow, or, failing that

(since it seems likely that Paddy's drinking will have left

little behind), from the Scottish Widows whose policy backed the

loan.

This prospect would most certainly leave something to be

"cleared up" about the policy. The insurance company would

hesitate to pay out benefits to the Dignam family until its

legal liabilty was known, and if it found that it would be on

the hook for repayment then it would want to reduce or eliminate

the Dignams' benefits. Paddy's unscrupulous listing of his

policy as collateral, then, appears to be threatening the

financial wellbeing of those he left behind.

Bloom apparently has promised to be the one to contact the

company about this matter because he too holds one of their

policies and is familiar with the firm. Ithaca reveals

that he has taken out life insurance with the Scottish Widows

at an impressive level. His desk drawer holds "an endowment

assurance policy of £ 500 in the Scottish Widows’ Assurance

Society, intestated Millicent (Milly) Bloom, coming into

force at 25 years as with profit policy of £ 430, £ 462-10-0

and £ 500 at 60 years or death, 65 years or death and death,

respectively, or with profit policy (paidup) of £ 299-10-0

together with cash payment of £ 133-10-0, at option." Bloom's

purchase of a substantial annuity, banking over the long term

on his daughter's financial security, is not the least

instance of his fiscal prudence, consistent with the habits of Jews and

Scottish Protestants far more than with those of Irish

Catholics.